Delayed receivables can severely hinder your business’ fiscal health. An efficient accounts receivable process is directly responsible for the well-being of cash flow into your business. Revenue looks good on paper, but turning accounts receivable into cash is essential for a business to continue functioning. To keep that cash flow coming in, ARCollect has super convenient features to enhance the accounts receivable collection process so you can get paid faster.

ARCollect is an A/R automation app for QuickBooks Online and Desktop. It makes receivables management and collections super easy.

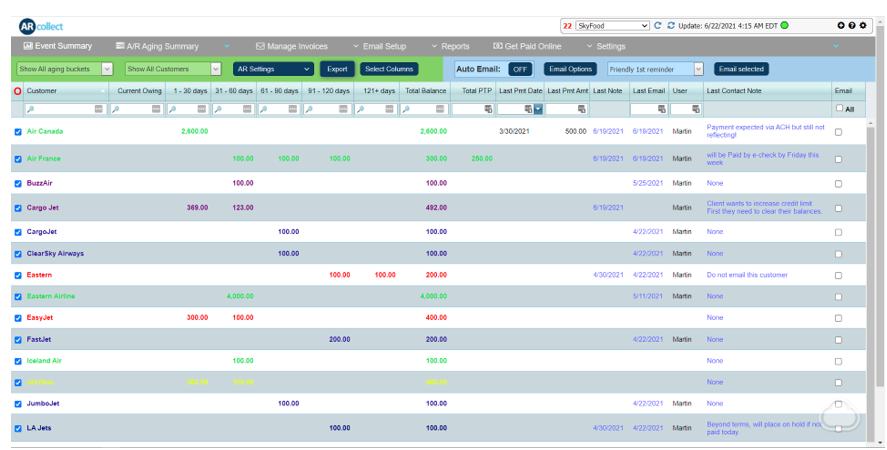

We had the pleasure of sitting down with Ivan Behr, CEO & Founder of ARCollect. Ivan walked us through the interactive dashboard where all of your collections are visible in one place. You can quickly and easily make notes, track customer payment behavior, categorize invoices and even send customized emails.

ARCollect also syncs with QuickBooks payments and allows clients to pay all invoices in one batch! You can also pay individual invoices by clicking on them and you’ll be taken directly to QuickBooks!

With ARCollect, managing your clients’ A/R can even become another revenue stream for your firm. One option is to resell ARCollect where you set your client up on your account. Another option is to offer full-service A/R where you directly manage your client’s receivables. And finally, you can consult your clients on ARCollect.

Check out ARCollect’s free 30 day trial (no credit card required) where you get access to the unrestricted version of the app, full support, and the ability to cancel anytime.

To learn more about drink recipes and show details follow us on our Facebook page or check out our website www.theappyhour.com.

Register for The ‘Appy Hour by clicking here.

To learn more about the show sponsor, follow the link to: ARCollect