Paying a bill manually is fast becoming a thing of the past. Businesses are moving steadily toward digitization, with tech-savvy accountants and bookkeepers in the vanguard. The real question is not whether you should use a bill pay app, but rather which one best suits you and your small business clients. Choosing a bill payment solution impacts all aspects of your firm, from time management and productivity to client retention. That is why thorough research is required when selecting an app, to ensure it’s not only right, but right for you and your clients. To help you decide, we’ve gathered a list of considerations you should take into account.

Is it simple enough to use?

Simplicity is the name of the game. Any service you choose has to be easy to use for you, your staff, and your clients. And it all starts with the registration and onboarding process. Overcomplicated apps with too many unnecessary “bells and whistles” require a long learning curve. The time between registration and scheduling the first payment shouldn’t take longer than a few minutes. If the app takes longer, it will deter and annoy your clients. A friendly, clear, and straightforward user experience is key here. The same logic applies to daily work. Whether it’s you or your client handling bill pay, scheduling payments shouldn’t require more than a few clicks. Any extra step, unnecessary click, and second in excess add up over time to hours a week and affect your productivity.

Tip: Test the app for registration time, clarity and simplicity. Try adding and scheduling a bill and explore the app’s functionality. Ask an untrained person to do the same and share their experience with you.

Does it sync with your accounting software?

Are you using QuickBooks Online? There’s no reason in the world that you should re-enter the same bill details twice. Your bill pay app should sync with QBO seamlessly so that data-entries (such as adding and paying bills, vendor details, etc.) are automatically synchronized across systems. Settling for an app that doesn’t offer seamless 2-way sync, you will not only consume your time on data-entry and double the risk of human error.

Tip: Make sure the app offers seamless sync. Test the sync in both directions to make sure it delivers on its promise. Add a bill on QBO, and see if it automatically shows up on the app. Then pay it on the app, and see if it’s automatically updated on QBO. Then, repeat the sync test, this time by adding a bill in the app.

Does it promote communication and collaboration with your clients?

Communication, transparency, and collaboration are the cornerstones of a relationship of trust with your clients. That is why in-app features, such as e-mail notifications on payments and payment approval workflows, can simplify, improve and streamline your communication. The process should be quick and intuitive. Most small and medium business clients don’t need to set up multi-level labyrinth-like approval processes. They (and you) need to be quick on their feet while maintaining control and visibility over their expenses.

Tip: Grade your app on its ability to provide approval workflows, and juxtapose that with simplicity of use for your clients.

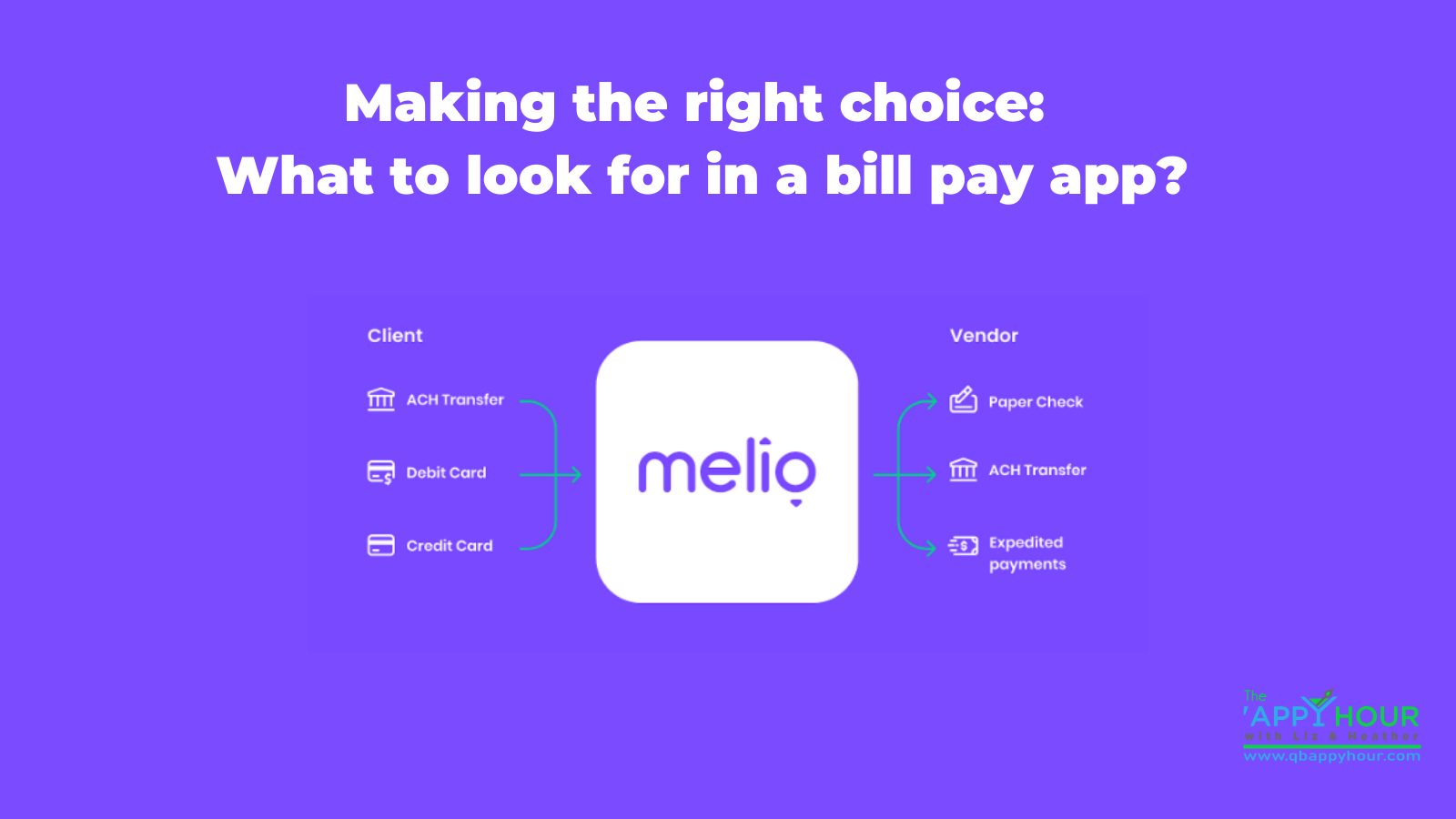

Does it offer payment ubiquity and flexibility?

You have a client who prefers paying via ACH transfer. Another prefers using their debit card. A third client uses several payment methods, and a fourth wants to pay with their credit card, to extend their float. On the receiving end, some vendors still insist on getting paper checks. The app should also enable you to schedule multiple and recurring payments to save time and hassle for you and your clients. But how do you accommodate all these options? It depends on the app. Make sure the app offers a wide array of ways for your clients to make payments, and allows vendors to choose how they want to get paid (regardless of the payment method used on the client’s end).

[image: Melio payment flow]

Tip: Review the payment methods and advanced special features provided by the app. Make sure it accommodates all the payment methods preferred by your clients and their vendors, in all variations.

Is it designed with accountants and bookkeepers in mind?

Accounting professionals handle multiple clients and often need to juggle between them throughout the course of the day. So your app should include a dashboard display of all your clients’ accounts on one screen. It should be easy-to-navigate between clients, with clear visibility of each client’s bill status and easy access to each account – all from a single login.

[Image: Melio Accountants Dashboard]

Tip: Test the app’s visibility and accessibility. Do you have an overview of all your clients on one screen? Can you enter and exit client accounts quickly, without the need for separate logins?

How much does it cost?

Some bill pay apps charge subscription fees, and collect additional fees for various services and features. For example, you may pay around $40 monthly per user, and $10 more if you also want it to sync with your accounting software. But you and your clients don’t need to spend hundreds of dollars just to be able to pay and get paid online. In fact, it doesn’t have to cost anything at all. There are several free bill pay apps that offer unlimited users, and free basic payment options without sacrificing functionality or reliability. Make sure to check them out, as they might be a good fit for your firm, and save hundreds of dollars for you and your clients.

Takeaway: Calculate the yearly spend on the app depending on the features and number of users you’ll need and make a head-to-head comparison between your favorites.

Hopefully, with these tips, you’ll be able to make a more informed decision as to the right bill pay app for you and your clients.

If you’d like to know how Melio’s bill pay solution for accountants and bookkeepers measures up to these standards, just click here to learn more.