Heather & Liz’s Ultimate Guide to Year-End Planning

Year-end has always been an opportunity for accounting professionals to look back at their year and develop strategies and processes to transform their work and deepen their client relationships. Well, it’s year-end 2020. This year has presented challenges that many of us could never have imagined, and the miracle has been how certain partners have stepped up to support and empower us. Without a doubt, one of these partners is ADP.

Ways to strategize year-end

I KNOW most of you have been providing service above and beyond your client engagements’ original scope, and year-end is the perfect time to review your client list and fees.

This exercise will help you uncover what client needs are not being met and opportunities to bring additional value and paid services to your clients and firm. It’s also a good idea to evaluate your existing client relationships to determine the types of clients best suited to your firm.

Once you’ve done your client analysis, plan to send engagement letters to your clients by December 1st. And consider offering an incentive to those clients who sign early – so you have as much information about your upcoming workload. Capacity and engagement planning done early will help ensure a smooth and less stressful busy season.

QuickBooks Year-end Tools you have but may not using

- Client Overview

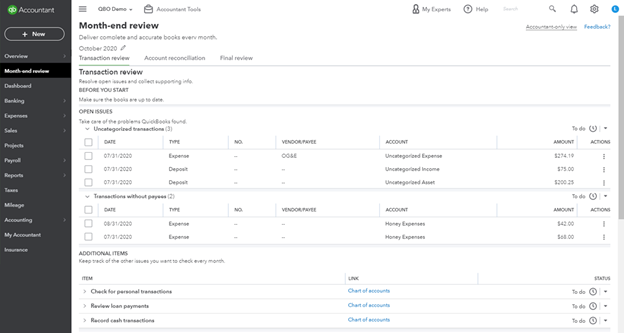

- Month-end Review

- Prep for Taxes

- Cash Flow widget

- Client Requests

Our App partners have built-in year-end planning tools, too! For example, ADP has invested heavily in providing a holistic suite of tools and resources to their accounting partners with their award-winning. The Accountant Connect portal is brimming with free CPE opportunities.

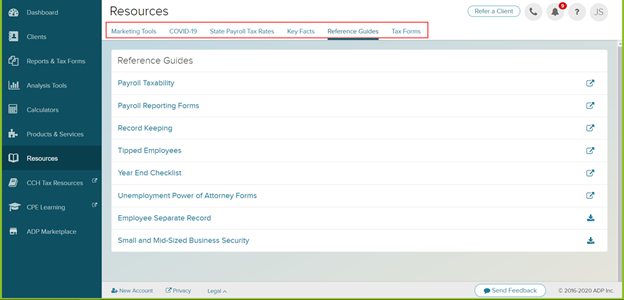

ADP – Accountant Connect has:

- Year-End guide

- Calculators

- Analysis Tools

- Resources

- Free CPE

ADP also offers a complete suite of tools that should be evaluated every year with your clients. Many businesses want to provide benefits are a way to recruit and retain employees.

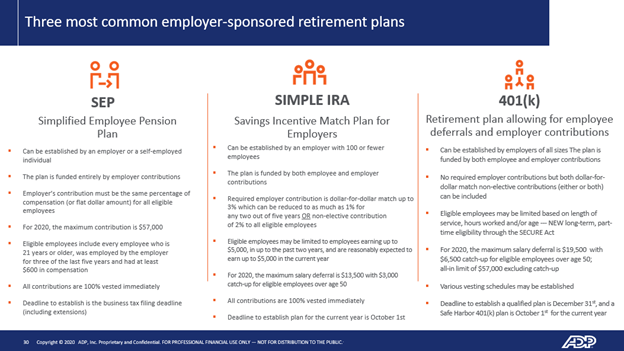

ADP Retirement Plans

Amber Harms, The Retirement Services VP of Channels, joined us to explain the differences between SEP, SIMPLE IRA, and 401(k) programs ADP offers.

Finding the best fit for your client can be challenging. My recommendation is to use the resources available to partner with and expect to help determine which retirement plan might be the best fit. There are several considerations: how many employees want to participate, how much the employer would like to contribute, and how flexible their plans are. These are all great questions, and because this is not my firm’s primary focus, I reach out to partners to offer guidance.

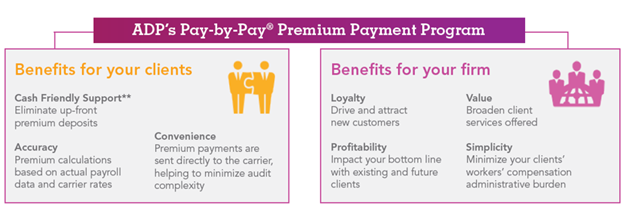

ADP Insurance

Insurance is another benefit employees’ are seeking. Aaron Booth, ADP’s Leader of Accounting Professional for Group Health, joined us to present an overview of the variety of programs ADP offers. One of the most attractive options to many small businesses is the ADP’s Pay-by-Pay Premium Payment Program, which allows payment to be made instead of a large upfront payment.

To learn more, drink recipes, show details, follow us on our Facebook page, or check our website www.theappyhour.com.

Register for The ‘Appy Hour by clicking here.

To learn more about the show sponsor, follow the link to: ADP

Click here to view The Appy Hour with ADP episode.