By: Webgility

To say that sales tax rules have never been more complex would be an understatement. There are currently more than 12,000 taxing jurisdictions in the U.S. that tax at different rates depending on the time of year and what is being sold. Adding to that, “economic nexus” policies are in effect in 40+ states and affect all retailers who sell online. This is a relatively new change that has swept the nation after a key Supreme Court ruling in 2018.

The nature of the shifting landscape is such that ecommerce sellers need accountants, bookkeepers, and tax experts now more than ever.

Economic Nexus, Explained

Ecommerce tax laws were changed in 2018 with the South Dakota vs Wayfair Supreme Court decision. It ruled sales across state lines could be taxed based on the sales tax laws in the states where sales were being made. This was a major turning point because previously, tax was collected at one rate based on where the business was located. Now, there are economic nexus elements to consider.

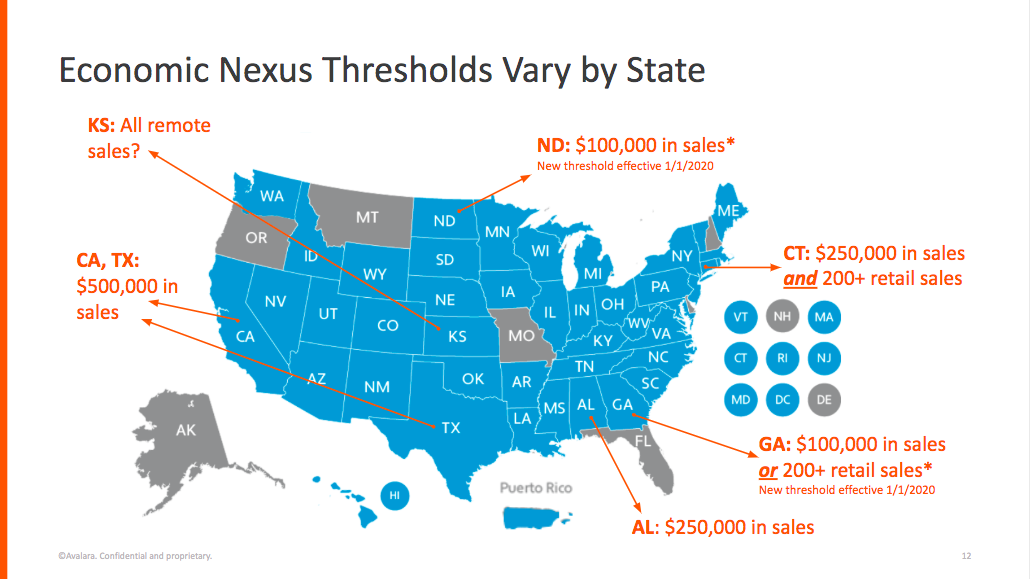

Economic nexus is a tax collection obligation imposed on sellers based on their level of economic activity within a state. Rather than basing it on a business’s physical presence, it is dependent on sales revenue, volume, or both. Once a seller’s revenue or volume passes the set threshold, sales tax has to be remitted to that state. Each state has its own criteria/threshold, but the overall goal is to level the playing field between traditional and online retail sellers.

Some examples of economic nexus thresholds—

- Florida: 200 transactions OR retail sales exceeding $100,000

- Texas: Optional single local use tax rate for out-of-state sellers

- Louisiana: 200 transactions OR sales exceeding $100,000

- Georgia: $100,000 in sales

Another thing to note: Amazon and eBay are two marketplaces that handle remittance automatically, but otherwise sellers and their accountants and bookkeepers need to track ecommerce transactions in order to stay compliant with sales tax laws.

3 Ways to Track Ecommerce Sales Tax

Sellers, accountants, and bookkeepers can track sales tax using QuickBooks POS, the online store(s), or with a third party application.

QuickBooks POS

These are the situations in which sellers and clients can easily use QuickBooks POS to track sales tax: Sales are only being made in one location, sales in other locations fall below those states’ thresholds for remittance, or all the necessary tax locations are set up in QuickBooks POS.

Follow these steps to create new tax locations in QuickBooks Point of Sale:

- In QuickBooks Point of Sale, go to File -> Preferences -> Company and select the Sales Tax menu area.

- Add a tax location specifically for online store orders.

- Create the tax location in QuickBooks Point of Sale

- Set the tax rate percentage

Note: This is the tax rate that is currently being calculated in the online store at the time of sale. This online store tax location rate in QuickBooks Point of Sale must match the tax percentage created in the online store. Check the online store if you are unsure what this is. - Click on Finish, and your new tax location will appear in the tax location area in QuickBooks Point of Sale. When QuickBooks calculates the tax of an online store order, it appears in the tax field of a sales order.

Online Store(s)

This option removes QuickBooks POS from using its native tax functionality, instead opting to have taxes appear as a line item on the receipt. This requires setting up a new Tax Location and tax item to record into QuickBooks Point of Sale and should be used if you need to collect a variable tax rate for your state but do not anticipate collecting for other states. For example: In California, if a product is sold from San Francisco and bought by a customer in Fresno, the order should be taxed at the local rate for Fresno. But since the remittance goes to the same collection agency, using a single line item to track the tax allows for the variable rate and easy tracking of what is owed.

Tracking via the online store(s) can also be used as a ‘quick fix” to record the taxes collected accurately, but it cannot create or maintain the Nexus of Tax Locations. Therefore, because it records the total of taxes collected to a single item, it makes splitting apart what is owed to each state difficult.

Third Party Applications

If you have to collect for many different Tax Jurisdictions and do not have the ability to create and maintain a lot of Tax Locations within QuickBooks Point of Sale, these services will generally connect to the ecommerce store directly. More advanced applications like Avalara will even document how much tax liability is owed to each tax collection agency and help you accurately file with each state.

Automating Tax Tracking with Webgility Desktop

Webgility automatically syncs data from Amazon, Shopify, eBay, Walmart, and more to QuickBooks, so data is always accurate and up to date. See sales, returns, expenses, fees, and inventory on a user-friendly dashboard, and easily reconcile clients’ accounts to keep them tax compliant.

Why should you automate sales tax management and accounting/bookkeeping? Several reasons:

Accuracy. With a complete set of accurate and up-to-date data, accounting reports yield better, more detailed results. This makes it easier to identify clients’ profit centers (like categories of merchandise or regional sales) and where they should invest more or less of their time.

Efficiency. Reducing the time accountants and bookkeepers like you have to spend on lower-value tasks like data entry and proofing allows you to focus on higher value services-like providing strategic, profit-boosting advice-that set you apart from your competition.

Customer satisfaction. Greater efficiency sets you apart from your competition and drives client satisfaction and loyalty. And that leads to a healthier business, better reviews, more referrals, and, ultimately, higher profits.

Business growth. Being proficient in ecommerce accounting and advising opens the door to a whole new set of clients in a rapidly growing industry. Plus, the time you’ll save by automating accounting tasks that once required manual data entry will allow you to focus on pursuing new clients and growing your business.

Why Webgility for Sales Tax Compliance

The sales tax landscape is a complicated maze with thousands of tax jurisdictions and dozens of different sales revenue and/or volume thresholds that require ecommerce sellers to remit sales taxes in multiple states. There is plenty of room for human error if you’re still relying on manual data entry, but automation can alleviate these concerns. By automating sales tax calculations and returns to ensure your clients’ compliance, you can free up your resources and boost your efficiency, productivity, and profits.